MHCi Monthly Feature: January 2012

CSR and Employment – is there a connection? Is it the responsibility of corporations to create employment?

Dr. Michael Hopkins, CEO, MHC International Ltd

Modern methods of production have given us the possibility of ease and security for all; we have chosen, instead, to have overwork for some and starvation for others. Hitherto we have continued to be as energetic as we were before there were machines; in this we have been foolish, but there is no reason to go on being foolish forever.Bertrand Russell (1932..see full transcript on http://www.zpub.com/notes/idle.html, accessed Dec 2011]

Is it the responsibility of corporations to create employment?

There is much talk about creating jobs today as unemployment inexorably stays high around the world. Two issues immediately follow from such a statement. First, what do we mean by unemployment and second, why do we need jobs? Many people would say that I am splitting hairs and people need jobs of almost any kind. But, before I move to the main examination of this article which is can we expect corporations to resolve the issue of jobs, I cannot proceed without a quick digression on the two questions posed.

What is unemployment and why jobs needed?

The unemployment rate has a numerator, number not employed, and a denominator, the labour force. These are both measured by labour force surveys and, the indicator most often cited, is the definition provided by the ILO. Briefly, those not employed are those who did not work for money or income in kind for at least one hour in the previous week or day prior to the survey. Those in the labour force have to be in the labour force age range and, if not employed, have had to have done something to find work in the previous month. Thus one can be employed, for instance, even if income is ridiculously low. One cannot be unemployed if one has become discouraged from looking for work. Thus the remarkable change in the unemployment rate from 9% to 8.6% in November 2011 in the USA, for instance, was as much to do with the private sector increasing employment as it was with labour withdrawing from the labour force because they had become discouraged after not finding employment for some time. Long-term unemployment is a considerable problem and one can only imagine the terrible hardship of such people it impacts upon.

But we must also think of what is a job? Bertrand Russell ably wrote, reproduced above, that we do seem to have our priorities mixed up. People obviously need to work when that is the main way of receiving income. Yet, we treat all employment as the same when most struggle to survive on what they receive while, as the worsening income distribution statistics across the world demonstrates, some are benefitting enormously from current circumstance. Distressingly, as Krugman so often shows in the pages of the New York Times, most of these high income earners do nothing to create employment. Worse they make bets on outcomes that often make things worse. One only has to remember the collapse in financial institutions and the bail-out of too big to fail institutions to know that financial betting has been supported by many Governments through de-regulation and massive financial transactions to banks.

Increasingly, having a job doesn’t bring with it rewards necessary for basic survival. With attacks on reducing deficits through reducing public expenditure, we are increasingly left to the private sector to find the jobs. Cutting public expenditure in recessionary times especially those that are job related has struck many as foolish (as I argue below). Again, Krugman describes the hope that the private sector will take up the slack because confidence will increase as the public sector declines as hoping for a magic ‘confidence fairy’. The hope that the private sector will invest in a recession belies the fact that corporations are hoarding a vast amount of wealth that is not being invested. Further, the private sector will tend to invest, not necessarily according to national priorities but across oceans where emerging markets provide higher returns.

Basic income

In the vein of Bertrand Russell, some have suggested the need for a basic income to be paid to all individuals in society. This income would replace the myriad of public subsidies currently allocated, provide security hence income when there are no jobs, and be enough to meet basic needs. Clearly, production systems can provide the goods we need to great access without full employment. A basic income would therefore, theoretically, be very attractive. But beyond the calculation of whether it could be afforded, comes the process of passing the necessary legislation through our democratic institutions. Today, US congress will hardly pass anything that might raise public expenditure, for instance slightly raising taxes of the rich and maybe passing up the opportunity or a war or two, urges macabre thoughts i.e. we must await total collapse, the threat of global warfare before we do anything. It is well-known that our societies rarely adopt radical change without a major disaster. But I can hardly welcome catastrophe for our societies so sensible change occurs.

The result

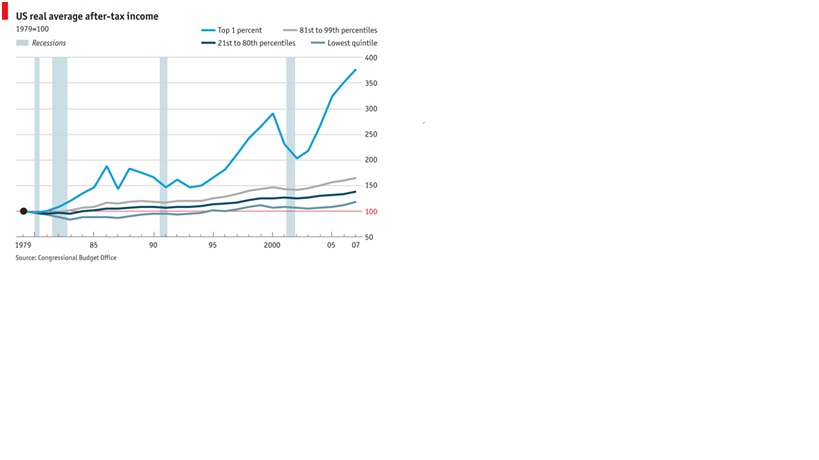

Nonetheless, one of the main results of increasing unemployment coupled with declining wages has led to a worsening income distribution as the now famous graphic for the USA illustrates.

Europe has not escaped either and as Cockburn wrote in CounterPunch[1] ‘The argument against the eurozone is that hard-faced Euro-bankers—their killer instincts honed at Goldman Sachs, Wall Street’s School of the Americas—have the power to act as the bully-boys of international capital and impose austerity regimes from Dublin to Athens, scalping the poor to bail out the rich.’ This, in turn, is what the Occupy movement is all about i.e. their starting point is highly unequal income distribution and their protest is to try and do something about it, as I have argued elsewhere[2].

CSR an answer?

Returning to the main point of this article, as unemployment levels remain high and will probably stay that way for the next year or so, until reflation and inflation encourage a different model as I shall point out below, should corporations be doing more to create employment? Is this part of their social responsibility?

The short answer is probably they should do something. As I noted above, the longer answer is what sort of jobs are we talking about anyway? Creating jobs for their own sake simply to transfer money so that it can be spent takes us into the trap so ably summarized in the Russell quote above. There are many types of employment yet much less is currently required to supply us all with the goods we need. What we really need is a system that re-cycles wealth earned into people’s hands as fairly, and sustainably, as possible. Unfortunately, we have not found an adequate way to do that. Communism attempted this and failed as market mechanisms were not allowed to work and shortages of just about everything replaced unemployment. It also led to concentration of power in non-transparent, repressive,vicious people and non-functioning committees. The market system works well as long as it has a strong dose of democracy although it does tend to move to a cyclical inheritance of creating unemployment in recessions often caused by excess public expenditure and then on things with hardly any forward investment multiplier such as tanks, drones, aircraft carriers, nuclear weapons etc. which we hope are not to be followed by a trumped up war.

CSR for private corporations also means social benefits and living wages, both of which by the way are subject to continuing debate and not something I can either resolve nor shall discuss in this article. Suffice to say that the one area that is in immediate need of attention is the question of socially responsible restructuring. As employment reduces, firing someone immediately with little or no warning subjects the victim to many more hardships than simply losing a source of revenue. Depression, feelings of failure and hopelessness quickly ensue. We all know it is easier to get another job, assuming they exist, if you are already employed. Socially responsible restructuring and re-training would address that issue and even keep the ‘fired’ on board as re-training and access to infrastructure such as an office are provided. Both of which require little cost although complications of security in our age of essentially service sector jobs needs imaginative solutions. Not often realized is the devastating loss of human capital that can hardly be re-invigorated as jobs return and demands for lost and skills increase. An highly skilled laid-off service sector worker is hard pressed to keep up with new technology as one iphone replaces another’s blackberry. The loss to a nation is hard to calculate but may easily drop future economic growth by several percentage points.

But large corporations, as the OECD graphic shows below, do not create many jobs themselves.

Obviously the structure of the business population varies between countries, but so does the distribution of employment. For example, in Greece, Italy and Portugal micro-enterprises account for more than 40% of employment, while they represent around 10% or less of employment in Israel, theUnited States and Luxembourg. In all countries shown, small and medium-sized firms withless than 250 employees account for the majority of jobs[3]. The implication is, often, that therefore investment should be made in small firms and medium sized (definition always varying but less than 250 employees) since they create jobs more rapidly than larger firms. However, anyone familiar with input-output matrices, will know about direct effects as well as indirect effects. Put simply, a small or medium sized enterprise needs larger enterprises and/or the public sector to provide the demand for their goods and services. Regrettably there is little or no research on that issue.

Yet, corporations are concerned about poor income distribution and high unemployment simply because, for most of them, they need markets for the goods and services they produce. The photo outside the US Chamber of Commerce shows the Chamber’s concern on JOBS even if the prescriptions and books cited in their website might miss a number of key texts[4]. As if President Obama didn’t know, the huge letters marking out, JOBS, can be seen quite clearly from the President’s private dining room on the second floor of the White House, just across the road in Washington DC (as could the author if the President was quick!).

The US Chamber website acknowledge that Americans have become increasingly concerned about the economy, their faith in the free enterprise system remains strong, according to a survey by the U.S. Chamber of Commerce. While government efforts to stimulate the economy are considered useful in the short term, we as Americans believe that it’s the free enterprise system that will grow our economy and create jobs over the long term. Surprising, therefore, that the US Chamber has been one, if not the, biggest lobbyist against just about any action by the current Obama Government including its stimulus package (variously agreed to have preserved or created 700,000-3 million jobs, the large range indicating the difficulty of estimation), while paradoxically admitting ‘government efforts are useful in the short-term’. In fact the right form of stimulus to create jobs was not entirely used for instance about a third was used to cover tax relief[5]. The point of course, to use a pun, is where to put the pointer between private markets and public intervention. One of the books missed by the Chamber was that of John Maynard Keynes (see below) and no lover of the public purse was he as he made a fortune working from his home with his stockbroker.

Under the guise of CSR, corporations need to start thinking how much of Government support they think the economy should absorb and where they come in to promote jobs. Providing lobbyist funds to the most outspoken and not well admired politicians is self-defeating. But even corporations are rent-seeking i.e. will invest in areas that are in their own best interest. As the graph shows below, simply encouraging the corporate sector to create jobs such as providing tax relief on investment for instance, may not necessarily work directly. There is a tendency to set up protectionist barriers to prevent the sorts of picture happening that we see in the graph. However, creating jobs overseas also means creating overseas consumers.

Source: http://thinkprogress.org/wp-content/uploads/2011/04/wherejobs.jpg accessed Nov 30 201

How to avoid recession in market economies?

Elsewhere I have outlined what would have been the Keynesian response today[6]. Briefly, his story is based upon the fact that economic growth is based upon the growth of private and public consumption and investment, and the balance of trade of goods and services (the Keynesian equation). Employment cannot rise unless there is economic growth that is not merely jobless growth due to solely productivity growth. In the absence of private consumption and investment and a poor trade balance, the only source of growth will be the public sector. Now with today’s urge to reduce deficits the ONLY solution has to be the private sector. But when that is not growing, as now, and when interest rates are historically low it makes sense to borrow to invest and/or provide transfer payments to the unemployed.

But, right across the world, few countries are currently borrowing to invest. The main outcome will simply be rising unemployment and continuing recession. So, sorry, the ONLY solution is stimulus unless the private sector thinks that low consumption will suddenly reverse. But it wont without a stimulus.

So are corporations irresponsible for not investing or are governments irresponsible for not introducing more stimuli? Well something has to move somewhere or we get stagnation or, as now, a deepening recession.

Now how would CSR work in that equation? Keynes was certainly in favour of Government responsibility[7]. Indeed, if we link CSR to his equation we can see, using today’s terminology, that economic growth needs to be ‘sustainable’ and fairly distributed, consumption needs to be conducted responsibly and energy saving, investment needs to be socially responsible and trade must not be exploitative and use harmful products. As it happens, all these ‘new’ concerns do, in fact, give rise to new forms of economic growth (of the sustainable kind) and different forms of employment.

But if even one of the aforementioned conditions is voided we are in for trouble. For instance, what happens when the rich get richer, as in many industrialized economies, their taxes reduce and taxes on the poor and middle classes increase? This has happened in Greece and the UK and is also suggested by some in the Presidential race in the USA…albeit slightly disguised with the need to simplify the tax code? Answer: You get ‘Occupy Wall Street’! See our suggestions (Occupy Wall Street Manifesto) for possible outcomes of the Occupy protest.

Despite the wonderful essay of Bertrand Russell, he does also note that ‘what a man earns he usually spends, and in spending he gives employment. As long as a man spends his income, he puts just as much bread into people’s mouths in spending as he takes out of other people’s mouths in earning’.

Conclusion

Despite the reluctance to re-read Keynes in today’s recession even with the hindsight of 75 years since his great work, counter-cyclical stimulus is required. But we also need both Corporate and Public Responsibility to create the sorts of Sustainable development we would all like to see across the whole planet. Certainly, large deficits have complicated matters and Governments must keep a close watch on bond markets for the coming decades. Yet, the political bias[8] both in the USA and Europe is to favor short-term stimulus by lowering taxes but not raise spending with an eye on long-term deficits through cutting public spending and raising taxes. This dual balancing act is, in fact, exactly what Keynes recommended. When times are hard increase stimulus, including public consumption and investment but quickly move to balance deficit budgets when growth returns. The danger in our economies today is that the former is happening too little while the latter, which depends on the former, simply may not occur in time leaving debt to rise to hazardous levels thereby, as Samuelson points out ‘undermining Keynesian economics as taught in standard texts’ and, more seriously, leading to perpetual unemployment and recession.

[Comments gratefully received on an earlier draft from Adrian Payne, John Lawrence and Peter Moss]

[2] http://mhcinternational.com/articles/occupy-with-responsibility-not-only-wall-street accessed Dec 18th 2011

[3] And as Prof. John Lawrence of Columbia University pointed out to me for even smaller enterprises (personal communication 23 dec 2011) more new employment (in terms of tax-paying employment slots/positions) are indeed spawned by establishments with <100 employees rather than larger, according to National Establishment Times Series (NETS) data in a 2008 article by Neumark et al for the NBER (2008) see http://www.nber.org/papers/w13818 (accessed Dec 23 2011)

[4] http://www.freeenterprise.com/about-the-campaign/?rd=n accessed Dec 2011

[5] By March 30, 2011, (just after the close of FY 2010) the program had spent $633.5 billion: $259.9 billion in tax relief, $181.7 billion in entitlements and $191.9 billion in contracts, grants or loans. (Source: http://useconomy.about.com/gi/o.htm?zi=1/XJ&zTi=1&sdn=useconomy&cdn=newsissues&tm=154&f=10&tt=2&bt=1&bts=1&st=11&zu=http%3A//www.recovery.gov/Pages/home.aspxRecovery.gov accessed 23 Dec 2011) Yet, as Peter Moss remarked (private communication Dec 2011) government spending and the fiscal deficit (i.e. stimulus) are high, and more could be made of the idea that better spending might make the stimulus more effective, even if more spending is not possible. If the extra spending were used for intelligently selected public projects it might do a lot more for the economy and jobs than just throwing money randomly into the population, much of which just gets saved or spent in China or India.

[6] http://mhcinternational.com/articles/occupy-with-responsibility-not-only-wall-street accessed Nov 16 2011

[7] John Maynard Keynes was extremely active in his campaign to encourage the government to take more responsibility for running the economy. In 1936 Keynes published his most important book A General Theory of Employment, Interest and Money where he argued that the lack of demand for goods and rising unemployment could be countered by increased government expenditure to stimulate the economy. His views on the planned economy influenced President Franklin D. Roosevelt and was a factor in the introduction of the New Deal and the economic policies of Britain’s post-war Labour Government